A new generation of fintech apps is changing the way remittances impact local communities in developing countries, turning money sent from abroad into powerful tools for financial inclusion, entrepreneurship, and access to essential services.

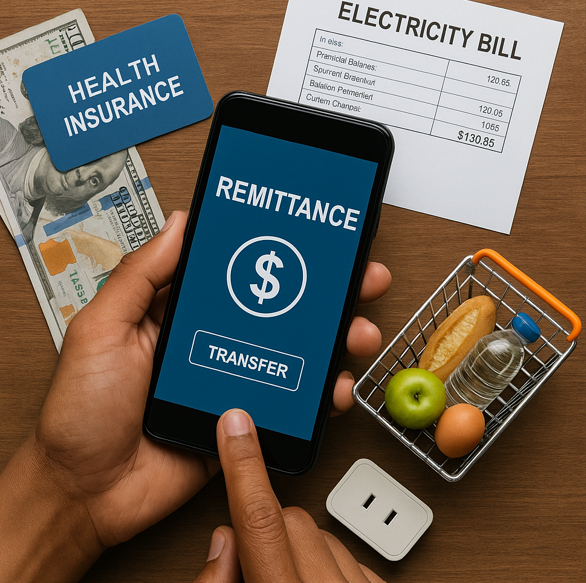

These mobile platforms now allow users not only to receive money from relatives abroad but also to allocate it directly to prepaid services such as mobile data, electricity, school fees, health insurance, and even micro-investment accounts.

«For years, my brother sent money home, but it was hard to manage,» said Rosa López, a user in Guatemala. «Now I receive the funds in the app, and I can pay for my kids’ tuition and buy groceries without needing cash.»

The apps often integrate with local digital wallets and offer rewards for saving or using funds toward productive activities. Some even include AI-driven budgeting tips based on user behavior and local prices.

According to the World Bank, remittances to low- and middle-income countries reached over $650 billion in 2024. With digital tools now playing a central role, experts say remittances are no longer just lifelines—they are becoming engines of development. Governments and NGOs are beginning to collaborate with these platforms to boost transparency, reduce fees, and promote financial literacy. The trend signals a shift from informal cash transfers to a more structured, tech-driven ecosystem with long-term socioeconomic benefits.